Welcome, Autumn Winfield!

Lutheran Metropolitan Ministry is pleased to welcome Autumn Winfield to the team! Autumn joins LMM as the new VP of Workforce Development.

Join LMM for the 2024 Charles R. See Forum on Reentry on April 26, featuring keynote speaker Yusef Dahl, Director of Entrepreneurship and Innovation at Lafayette College & Co-Founder of Real Estate Lab!

Join LMM for the 2024 Charles R. See Forum on Reentry on April 26, featuring keynote speaker Yusef Dahl, Director of Entrepreneurship and Innovation at Lafayette College & Co-Founder of Real Estate Lab!

The stories of redemption will premiere in full this September

Your Guide to Cuyahoga County’s Reentry Week (April 21 - April 27) Events:

Your Guide to Cuyahoga County’s Reentry Week (April 21 - April 27) Events:

The stories of redemption will premiere in full this September

Get your LMM gear ready for Spring! Our seasonal pop-up merch store is open now through Friday, April 19. New items and fun polo colors for Spring and Summer are here!

Get your LMM gear ready for Spring! Our seasonal pop-up merch store is open now through Friday, April 19. New items and fun polo colors for Spring and Summer are here!

The stories of redemption will premiere in full this September

The stories of redemption will premiere in full this September

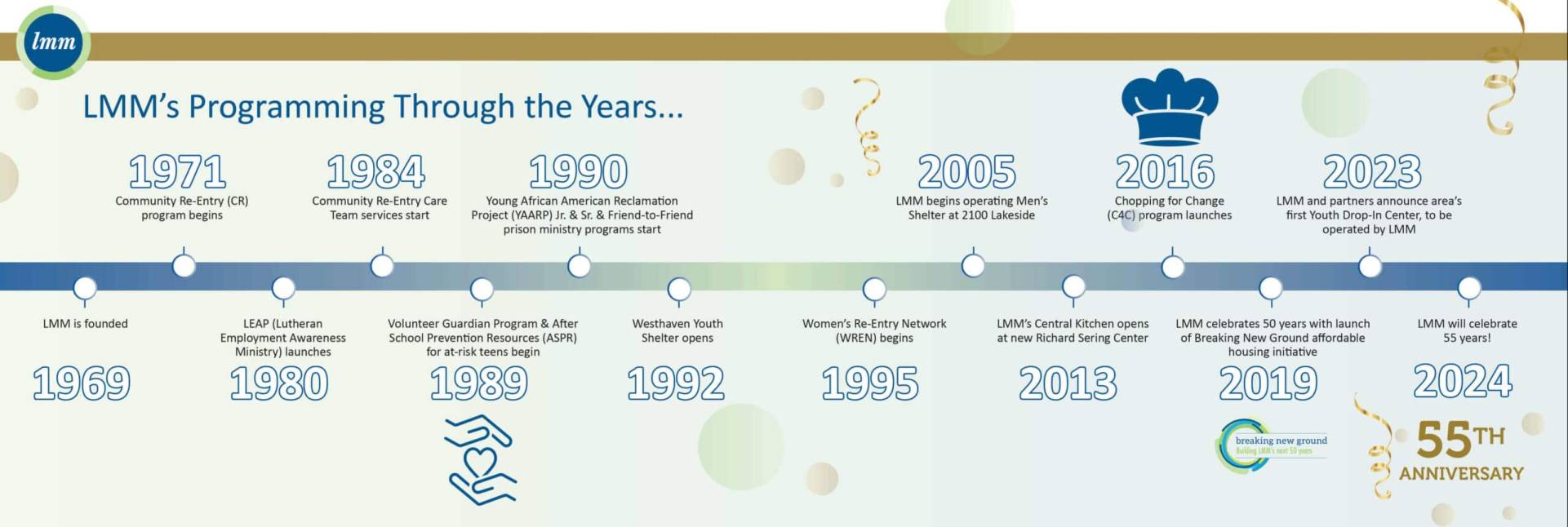

2024 marks 55 years of LMM promoting shalom (peace, well-being) and justice (right relationship) with those who are oppressed, forgotten and hurting. We are excited to celebrate 55 years with you! Stay tuned for more information regarding our 55th Anniversary celebration.

The stories of redemption will premiere in full this September

2024 marks 55 years of LMM promoting shalom (peace, well-being) and justice (right relationship) with those who are oppressed, forgotten and hurting. We are excited to celebrate 55 years with you! Stay tuned for more information regarding our 55th Anniversary celebration.

Micah 6:8

The stories of redemption will premiere in full this September

We're excited to announce our Building Maintenance & Repair program, a new vocational training program with a focus on light construction, building maintenance, home repair and remodeling as a high potential opportunity to change the trajectory of unemployed and underemployed citizens quality of life and upward mobility.

We're excited to announce our Building Maintenance & Repair program, a new vocational training program with a focus on light construction, building maintenance, home repair and remodeling as a high potential opportunity to change the trajectory of unemployed and underemployed citizens quality of life and upward mobility.

The stories of redemption will premiere in full this September

The stories of redemption will premiere in full this September

LMM, Cuyahoga County and community partners celebrated the expansion of the Men’s Shelter to 2020 Lakeside Ave. on March 5!

LMM is partnering with the Sisters of Charity Foundation of Cleveland and A Place 4 Me to open the first youth drop-in center in the area. It's an innovative solution and a game-changer for young adults experiencing housing instability.

Click the link below to learn more about this initiative.

LMM is partnering with the Sisters of Charity Foundation of Cleveland and A Place 4 Me to open the first youth drop-in center in the area. It's an innovative solution and a game-changer for young adults experiencing housing instability.

Click the link below to learn more about this initiative.

The stories of redemption will premiere in full this September

LMM's Speakers Bureau offers the unique opportunity to hear directly from experts in the fields of affordable housing, adult guardianship, criminal justice reform, homelessness and more. We love connecting with organizations and churches that support our mission!

LMM's Speakers Bureau offers the unique opportunity to hear directly from experts in the fields of affordable housing, adult guardianship, criminal justice reform, homelessness and more. We love connecting with organizations and churches that support our mission!

The stories of redemption will premiere in full this September

We’re committed to providing emergency shelter, supportive services and solutions to homelessness.

We aim to provide an avenue for employment by empowering individuals who face personal barriers.

YRS takes a holistic approach to meeting the basic needs of youth facing housing instability and adversity.

Guardians look after the emotional, social, financial and physical well-being of vulnerable adults.

Our advocacy work informs systems change at the local, state and federal level by leveraging the expertise of staff and the experiences of program participants to advocate on behalf of those we serve.

LMM creates innovative programs that serve with people who are homeless, youth who are facing adversity, older adults who are vulnerable, people impacted by the criminal justice system, and individuals with behavioral health needs.

Listening.

Serving.

Empowering.

Lutheran Metropolitan Ministry is pleased to welcome Autumn Winfield to the team! Autumn joins LMM as the new VP of Workforce Development.

Reentry isn’t a concept Malika Kidd ever thought would be part of her life journey, but incarceration for a drug offense changed everything.

Lutheran Metropolitan Ministry is pleased to welcome William Tarter, Jr. to the LMM team. Will joins LMM as the new Director of Advocacy.

Stay up to date with the most recent news from LMM

© 2022 Lutheran Metropolitan Ministry. Powered by Gas Mark 8

© 2022 Lutheran Metropolitan Ministry.

Powered by Gas Mark 8